Parijat Banerjee welcomed an audience of financial services, analytics, and business leaders to LatentView’s Datanomics event—an exclusive gathering focused on the potential to usher in a new era of customer experience in banking and financial services by unlocking Generative AI (GenAI)’s full capabilities.

Decades ago, it was common for customers to remain loyal to a single bank for their entire life. From checking to savings to a car loan to a mortgage to a credit card, one bank would own the entire customer journey and experience. This trend is quickly changing as customers explore the convenience and perks that fintechs bring to the table leveraging data and AI. These companies have largely rewritten the rules of customer experience with seamless, personalized services available 24/7.

Parijat cited Amiyatosh Purnanandam, a finance professor at Michigan Ross, who wrote in Forbes, “Traditional banks are facing an existential threat from fintech firms.” At the height of disruption, some even predicted the obsolescence of legacy banks. These disruptors’ advantage was their ability to seamlessly wedge themselves between customers and financial institutions, offering faster, easier transactions that appealed to consumers accustomed to instant gratification.

While legacy banks may have survived the initial wave of disruption, they can no longer rely solely on reputation. Customers have choices and don’t need to deal with a single brick-and-mortar bank for their financial service needs. In many ways, legacy banks must innovate or risk becoming obsolete. Today, delivering meaningful customer experiences at scale—through personalized interactions, omnichannel engagement, and AI-driven insights—is the new competitive advantage.

One of the core drivers of this transformation is GenAI, which offers a significant opportunity for banks to not only meet but exceed customer expectations by:

- Understanding customers more deeply: GenAI can analyze vast customer data to uncover hidden patterns and preferences.

- Personalizing interactions: GenAI can ensure financial services organizations can deliver the right messages to the right person at the right time, improving relevance and engagement.

- Scaling service effortlessly: GenAI-powered tools allow financial services organizations to provide cross-channel service seamlessly to an expanding customer base.

There are plenty of real-world examples that highlight how AI is already reshaping CX in financial services. Bank of America’s Erica is an AI-powered virtual assistant that helps customers check balances, make payments, and analyze spending habits to offer personalized savings tips. At Nordea Bank, the company has employed AI to automate operations, from claims processing to compliance, ensuring efficiency and accuracy.

While many banks have started to push into GenAI, many are still hesitant to jump in for various reasons. Many don’t know where their data is. Those that do, often don’t know if they can trust the data. Some are faced with legacy infrastructure and data that needs to be migrated to the cloud before they can even think about GenAI.

While challenges exist, and there are risks that come with pushing into any GenAI initiative, the truth is that failing to embrace and explore the potential of GenAI comes with the greatest risk of all — being left behind by your competitors. The consequences of inaction are significant:

- Inability to meet customer demand in a fast-paced, digital-first world.

- Increased exposure to fraud as competitors adopt advanced security measures.

- Missed opportunities for cost savings through automation and operational efficiencies.

- Employee attrition because of outdated processes that fail to engage and empower staff.

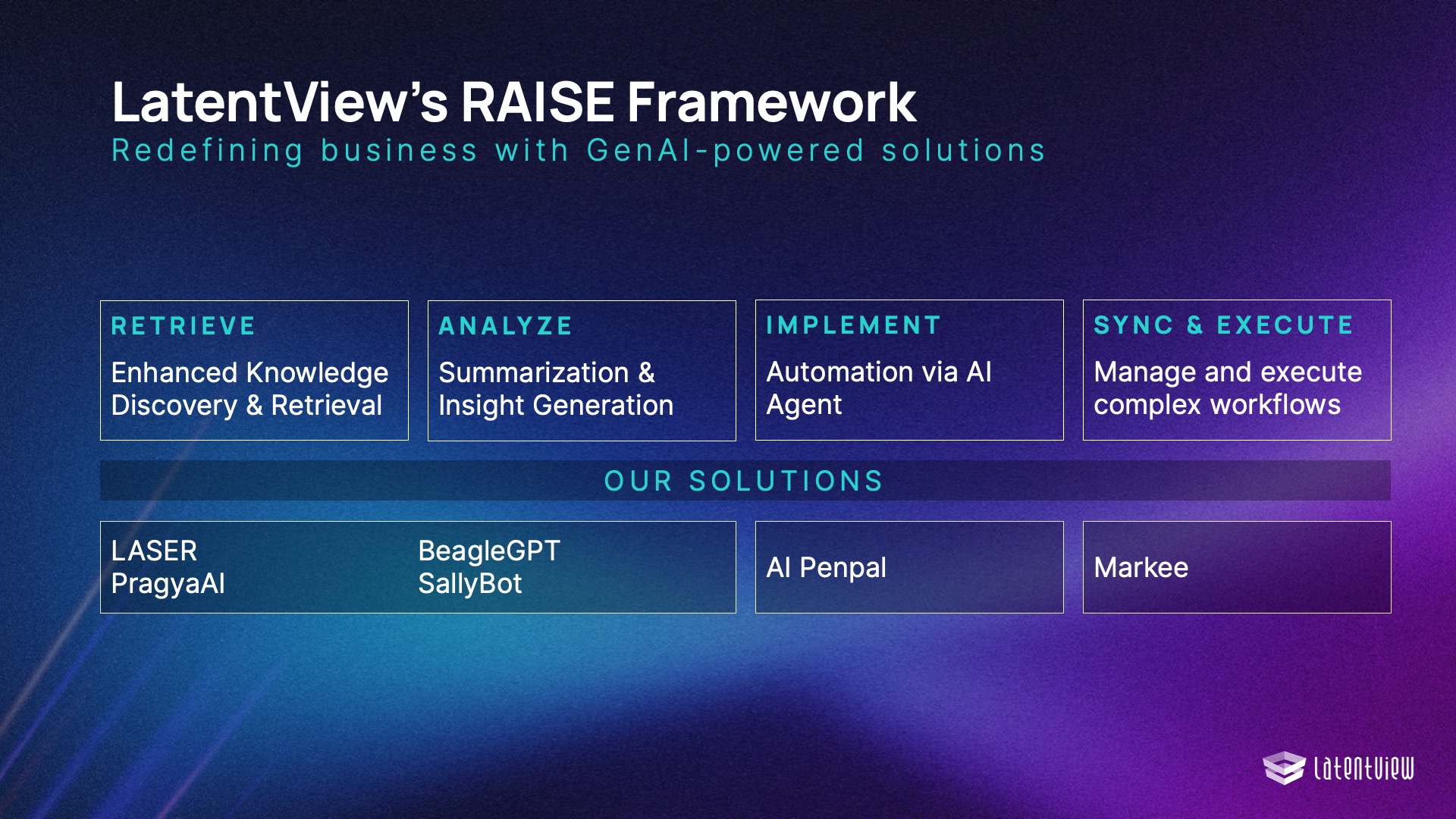

This leads to the question of where should an organization start? What are some of the immediate use cases for GenAI? At LatentView, we believe that the most immediate promise and profitability exists inside what we call the RAISE framework, which is designed to help businesses identify use cases, implement GenAI, and scale it for real impact across different business functions.

While these are just a small number of possible GenAI-powered solutions within the larger RAISE framework, it is clear that to thrive in this new era, banks must lean into GenAI-driven solutions that transform both customer and employee experience. The future of financial services lies not just in surviving disruptions, but in using them as a launchpad for growth.