In light of the quickly spreading pandemic, there have already been unbearable consequences in the global economy. Recently the World Bank quoted that “The financial sector is a key element to help countries mitigate the impact of the crisis on firms and households, and to support the recovery”. One cannot specify the importance of the Wealth management industry which acts as the barometer to the economic recovery of the country.

The Financial Advisors are a key segment within the industry, who day in day reaches out to people to understand the ground realities, more than anyone else in the market. Since the COVID-19 crisis started, the advisors and the advisory firms are having a challenging time surviving their business as the whole country is staying indoors closely observing the pandemic storm to calm down. On the other side, advisors are intensely monitoring the peaks and troughs of stock prices, while their clients are profoundly anxious about the fate of their investments and job insecurities.

This article aims to capture the repercussions of the crisis on advisors and their target clients. Our perspective also derives a few conceivable outcomes the sector can foresee in the near future.

Wirehouses remain steady, are advisor switching sides?

Wirehouses, being the foundation rock of the advisory business, are generally full-service brokerage firms offering research, investment advice, and order execution services. In the last decade, there has been a significant shift in advisors’ viewpoint on these firms. Many of the wirehouses like Morgan Stanley, Wells Fargo, and Merrill Lynch saw a steady increase in advisor attrition thereby losing millions in asset value. These trends revealed a poor compensation payout grid and conflict of interest in offering investment advice to be the underlying issues in their existing firms. While the wirehouse firms paid 42% as take-home pay for their advisors, the independent channel especially Registered Investment advisory (RIA) channels paid 65% take-home pay with an increase in profit for every dollar earned, also thriving cultural and growth opportunities. Thus, the global financial crisis played a crucial role in financial advisors breaking away from the wirehouse ecosystem.

Independence is the new mantra

As the advisors decided to step out of wirehouse firms, they evaluated the other advantages offered by other business channels like Independent Broker-Dealer (IBD) and RIA (Registered Investment Advisors). Charles Schwab Advisors Survey indicated that the number of financial advisors overall has steadily declined since the last decade —a decrease exacerbated by the 2008 financial crisis. But this has especially strengthened the RIA business channel. Taking account of independency and high compensation, the advisors had the opportunity to build their business model catering to varying clients’ demands. According to Fidelity’s reports, more than half of advisors have switched to independent channels in 2018. 78% of them have witnessed a greater upside in earnings with technology driving their day-to-day business. A recent research report by Cerulli found that advisors who prefer the RIA model cited higher payout (43%) and greater marketing flexibility (35%) as major factors for considering switching channels. To encompass the overall shift in the thought process of the advisors the below factors were instrumental:

- Higher payout

- Greater control over revenue and expenses

- Flexibility in portfolio construction

- Appealing clients’ interaction

- Leveraging technology

Shifting ground and race for consolidation

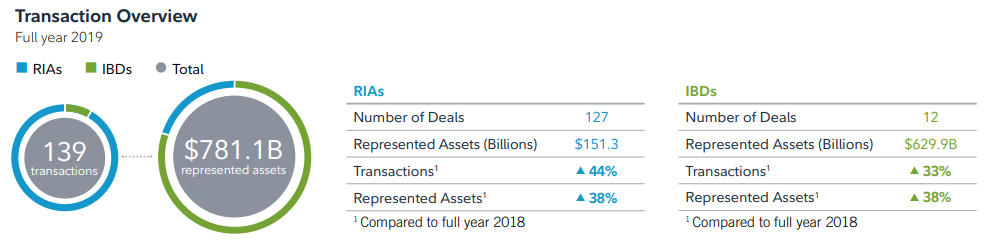

As competition intensifies, firms strive hard to help its advisors stand out in the field. Pricing which is the key differentiator upon all other factors forced firms to find new ways to reduce transaction costs. The Industry has been seeing unprecedented Merger & Acquisitions as 2019 was a record-breaking year for RIA and IBD’s with 139 transactions representing $781.1B AUA (Asset under Administration) in total, fueled by the following factors:

- Increase in operating costs

- Large private equity recapitalizations

- The inflow of substantial external capital

The below picture captures the extent of M & A in Q4 2019. With coronavirus adding more pressure to their operating economies, the numbers are set to increase. A survey conducted by EY group shows that 56% of executives tend to pursue M&A in 1 year, with 38% on business resilience & 39% expecting valuations to fall.

Backing the industry expectations, a closer look at the industry reveals that though independent advisors benefit from a better economic scale, few of the business owners are finding difficulties to sustain their stand-alone business. Even the pre-planned mergers and acquisitions plummeted values. Taking cues from the 2008 financial crisis gives a glimmer of hope, where the number of deals had dropped but firm valuation became positive. Therefore, the valuation drop is a silver lining during the market downturn and thus more mergers and acquisitions are likely to happen in the short term.

Virtual Advisory Model: The New Normal

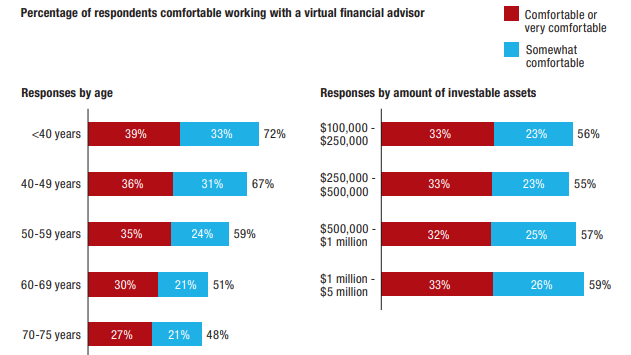

Enhancing the client experience has been one of the important factors which contributed to the advisor migration. It is of paramount importance to assist the panicked clients whose hard-earned investments are at stake. Tough times like these made routine services like collaborating with clients, managing their assets, and choosing new investments based on short- and long-term strategies complex. As everyone is locked indoors with travel restrictions, virtual financial advisory models (video conferences and chat applications) have been assisting advisors in keeping their client’s expectations in check.

As discussed earlier, technology support and collaboration tools were key USP’s for advisors to switch channels. This has two thronged purposes, enabling better work management and improving client experience. Since the advisors are venturing into a new workplace model, the comfort zone of their clients is also crucial. More than half of clients are supportive of the advisor’s decision to switch to independent channels during the crisis. Moreover, the flexibility in fees in an independent firm helps advisors retain their clients. During the crisis, a successful virtual model delivers cost reductions leading to better customer satisfaction scores compared to in-person models.

Key Takeaways

- OPPORTUNITIES FOR FIRMS DURING MARKET DOWNTURN: The independent business model set to attract more advisors who are breaking away from their existing wirehouse firms.

- ACCELERATION IN INDUSTRY CONSOLIDATION: As the M&A industry has survived the past financial crisis, the financial institutions can strengthen their scale, extending their networks with digital business models due to valuations drop.

- SPOTLIGHTING THE ADVISOR MOVEMENT: Advisors tend to walk into independent channels offering their clients greater compliance in investment choices and increase the value proposition of their business.

- TAILORING CLIENT ENGAGEMENT IN TIMES OF PANDEMIC: Considering the unavailability of office premises discussion, a virtual advisory model can be facilitated to provide innovative wealth management strategies.

Conclusion

The COVID-19 pandemic is expected to accelerate the appetite for breakaway advisors to enter independent channels (RIA), where they can grow their business by adopting technological features to boost their revenue. Industry perspective is although the M & A activities are currently suspended, we anticipate certain industry consolidations by leveraging lower valuations in the short term with a high return on capital over time. The outbreak has also pushed & opened doors for advisors to operate remotely thereby adapting virtual business models to deliver timely guidance for their clients to prioritize financial goals.