Introduction

The COVID-19 pandemic has proven to be a tipping point affecting almost all sectors of the economy. In the efforts to keep their workforce safe, enterprises have rapidly adapted to remote working as the new normal, with companies currently running almost all functions, including mission-critical ones remotely. With schools and universities closed due to the pandemic, it has become a norm for educational institutions to include digital tools to impart educational content remotely. Thus the pandemic forced educational institutions to quickly change their digitalization strategy from ‘planning to become digital’ to actually ‘being digital’.

Hence, given the rise in the need for remote working and digital learning, the Personal Computer (PC) industry has seen an increase in demand for devices.

Outlook Before COVID-19

According to reports by major research firms like Gartner[1] and IDC[2], 2019 was the year of considerable growth for PC shipments, which was last observed back in 2011. This growth can be mainly attributed to the demand from the business consumers for Windows 10 upgrades in the EMEA, US, and Japan as the support for Windows 7 was coming to an end. The forecast for 2020 from most reports stated the wave of demand brought by Windows 10 upgrades would soon die down, and unless there is an innovation in the market, the growth would not be sustainable.

Impact of COVID – 19

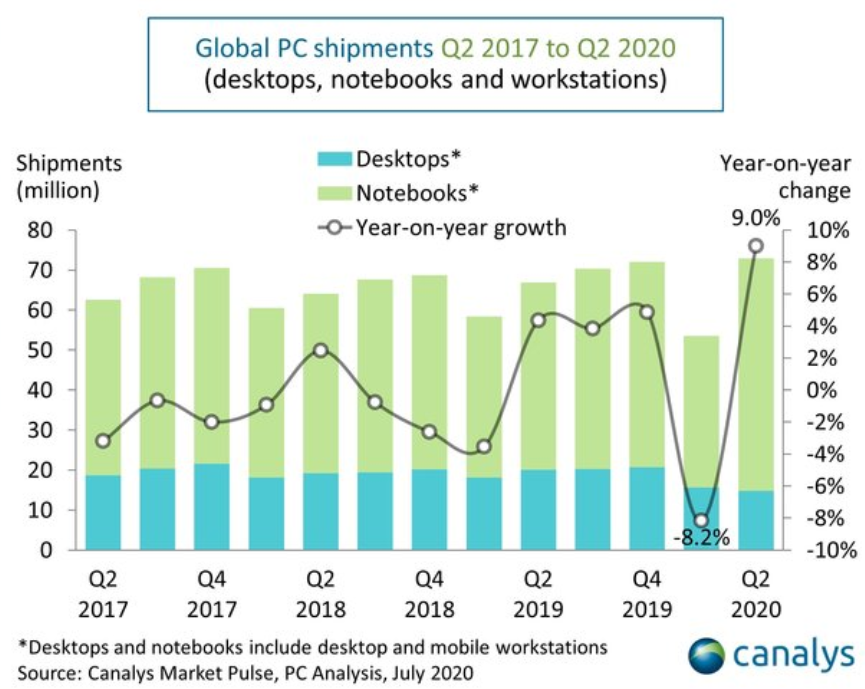

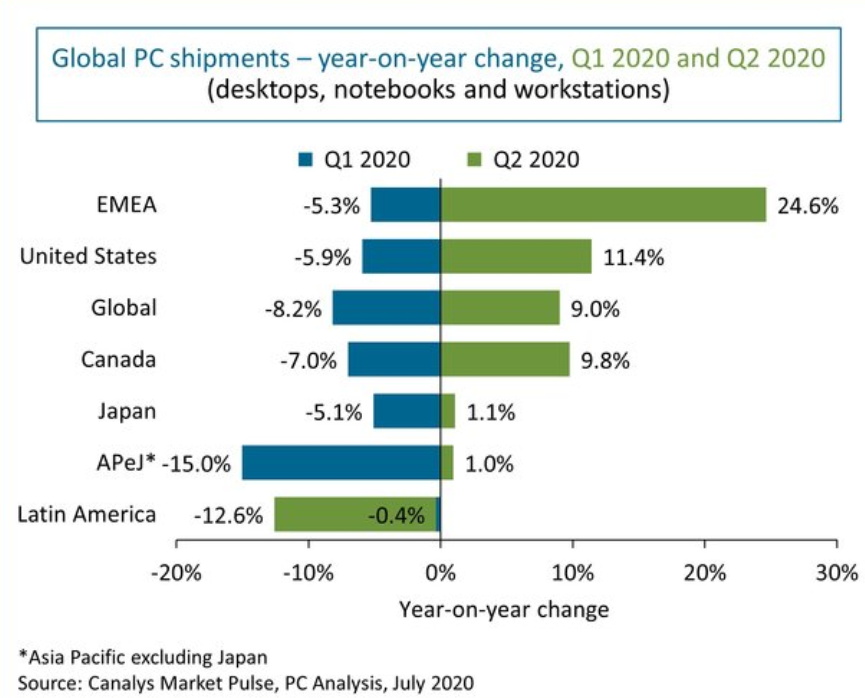

China, which was the epicenter of the pandemic, is also one of the largest PC suppliers. The pandemic affected the supply chains of most PC firms who depend on China for their entire supplies. Thus, the Chinese supply chain disruption greatly impacted the supply in Q1 2020. This caused shipments to drop drastically in the same quarter. Contrary to the predictions of nominal growth in shipments for 2020, the pandemic caused a swell in demand for PCs post the lockdown period in Q2 2020. According to Canalys[3], this caused the global PC shipments to reach 9% compared to the shipments back in Q2 2019.

Notebooks and mobile workstations have been at the center of the demand surge with 24% YOY[3]. Notebooks became an integral part of many businesses’ digital strategy as the pandemic forced them into remote working. With many finding it successful, companies are now choosing to implement it on a larger scale. The same holds for educational institutions, where they have moved into delivering digital curricula, thus driving notebooks’ demand. Simultaneously, shipments for desktops have seen a decline in 2020 because of the current need for mobility.

Regionally, the markets such as EMEA, the US, and Canada were well equipped to transition into the new normal of remote learning and working saw growth in Q2 2020. Markets where the customers are more price-sensitive, such as Latin America, saw shipments falling further in Q2 2020[3].

What is interesting to note is that the momentum gained in Q2 2020 has continued into Q3 2020 as per several market reports. Notebooks are driving PC shipments globally, with different regions catching upon demand for portability for business continuity, education, and entertainment.

Partnerships and New Product Launches

The pandemic has brought about the need for Notebooks to meet educational, business, and personal use. The growing demand and popularity of this PC segment have led many manufacturers to venture into new divisions and price offerings to take advantage of the market rush.

In terms of OS, Windows leads the market even during the pandemic, with almost all major manufacturers providing a model with Windows OS. However, one of the exciting developments during the pandemic has been Chromebooks’ growing popularity due to these devices’ security and cloud capability. Chromebooks, mostly market leaders in the K-12 educational segment shipments in the US[4], saw a growing demand in commercial sectors during the pandemic. Google has also revealed that sales of Chromebooks in the US grew by 127% YOY in Q2 2020, compared to just 40% for Windows and Mac laptops[5]. Furthermore, Gartner’s recent report reported that Chromebooks’ shipments grew by 90% [6] in Q3 of 2020 compared to Q3 2019.

To ride this popularity wave, Google has also launched an exclusive portal for Chrome OS app development – ChromeOS.dev, an online hub with Chrome OS resources for technical developers, designers, product managers, and business leaders. To further drive Chromebooks’ enterprise segment, Google has announced its partnership with Parallels to bring Windows apps to Chrome Enterprise[7]. Considering the popularity Chromebooks are enjoying now, it’s no surprise that many new Chromebook offerings are in store for the future.

As per IDC reports[8], Apple’s market share has also increased from 7% to 8.5%. Apple had also launched a new 13-inch MacBook Pro in May 2020. There were further developments in terms of the new M1 chips. These M1 chips not only boast performance and efficiency but would also provide better control to Apple.

Future Outlook

The need for mobility has created opportunities for the Notebook industry during the pandemic. Analytics can help grab these low hanging fruits by identifying the best customer to sell the right product. Marketing mix modeling can help brands decide the effectiveness of various marketing initiatives in increasing Return on Investment. The companies can also leverage customer insights for product innovation. To fully utilize the growing demand, the manufacturers need to work on their segmentation strategies and price offerings to capture the market when the demand still exists. Even with many factories running in full capacity post the pandemic, lockdown supply issues still plague the PC market. Manufacturers are still finding it hard to find components – screens, processors, etc. Meeting the sales forecasts for 2021 is uncertain because of the order fulfillment issue. Addressing the supply crunch for PCs’ demand due to the pandemic would be the main focus areas for most manufacturers.

References:

3.https://www.canalys.com/newsroom/canalys-worldwide-pc-market-q2-2020

6.https://chromeunboxed.com/chromebook-market-share-sales-growth-q3-2020

7.https://www.parallels.com/blogs/google-chrome-enterprise/

8.Traditional PC Market Delivers Another Quarter of Double-Digit Growth in Q3 2020, According to IDC