Healthcare Payment Integrity is a process of ensuring that the responsible party is paid the right amount for appropriate services rendered to the eligible members. Payment Integrity is often considered as a post-pay effort. Payers after settling the necessary sum owed to the providers, identify claims that have been overcompensated and request for a reimbursement from the concerned party. Approximately 3-7% of medical claims are paid incorrectly. In this article, we discuss how Intelligent Automation can transform three significant areas of Payment Integrity – Provider & Policyholder fraud assessment, Overpayment, and Subrogation.

Provider & Policyholder Fraud Assessment:

Let us look at some of the instances of fraudulent activities carried out by both providers and policyholders.

- Provider Fraud Activities

- Increasing the overall cost of hospitalization by including treatments that were not necessary

- Making duplicate claims on the same encounter

- Policyholder Fraud Activities

- Filing claims for treatments that were never administered by forging documents

- Falsifying details to become eligible for the policy

Uncovering such instances by extracting behavioural features of providers/policyholders (obtained from the actual fraud claims) and coupling them with the domain knowledge obtained from experts in the industry, we can effectively identify fraudulent claims earlier in the prepayment phase of claims operations. Though the maturity of Intelligence is high in these areas, there is always scope for improvement with cutting-edge ML algorithms providing high accuracy.

Overpayment:

Sometimes providers are overcompensated for the services provided, and this results in an overpayment. Mostly it is the insurance carrier that makes the overpayment to the providers. Approximately three percent of the total claim volume can be overpaid, according to Frgsystems. Fraud and billing error costs Medicare programs around $60 billion a year. An overpayment happens due to several reasons such as improper medical coding, duplicate payments, and fraudulent provider activities. Let us consider an example of a billing mistake. Medical staff wrongly coding a bilateral cataract surgery (Actual CPT code 66982-50) as cataract surgery for individual eyes (CPT codes 66982-RT and 66982-LT). As a result, insurers overpay for the surgery provided.

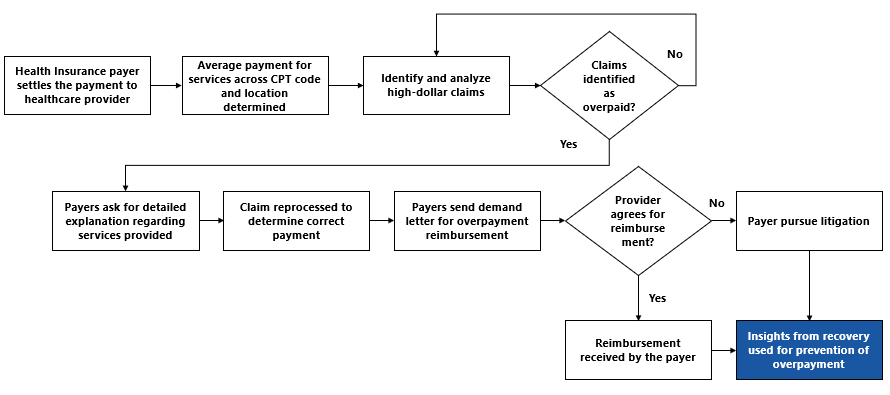

The process begins with identifying complex high-dollar claims (say claims value greater than $50K). Analyzing these claims with average payment provided for services across each CPT code and location, overcompensated claims are identified. Payers then ask a detailed explanation for the service provided. Based on the reply from the provider, insurers reprocess the claims to determine the correct payment and send demand letters to the concerned party for reimbursement. , The overpayment process flow, is as follows:

Most of the activities in the above process can be automated. However, features determining overpayment are used to train the data in the prepayment phase to identify overpayment scenario effectively. This is where an Intelligence layer is added to the process.

Subrogation:

Health Insurers, at times, pay medical expenses related to claims caused by accident, dangerous or defective products. They have a right to recover such money from the third party who is responsible. This is called subrogation. Subrogation happens after the payment is made to the providers. An example of subrogation would be an instance where the policyholder gets injured in an accident caused by some third party.

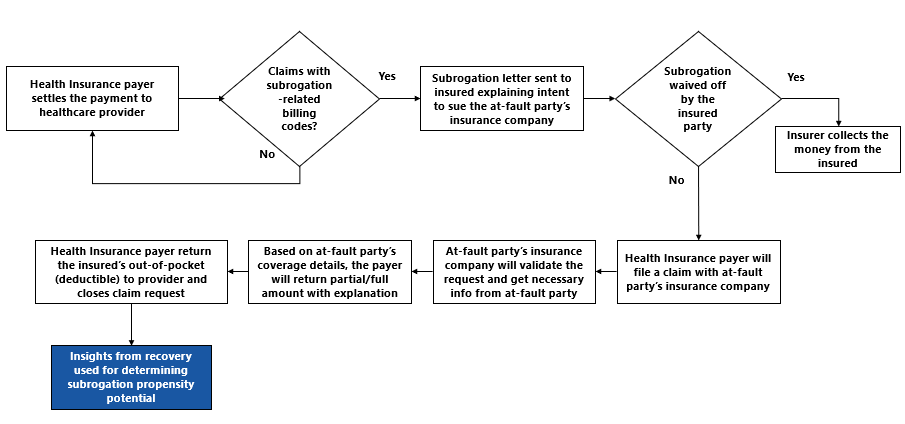

Claims for subrogation are identified by mining for CPT codes related to accident, self-injury, and incidents relating to damaged/defective goods. The insurer sends subrogation letter to the policyholder explaining the intent to sue at-fault party’s insurance company. Policyholders at this instant may choose to waive his subrogation right. In this case, the Insurer collects the money from the insured. If a subrogation waiver does not happen, insurer files a claim with the at-fault party’s insurer and decides whether to proceed litigation based on their response. The Subrogation process flow is as follows:

This is a highly complicated process as it involves several stakeholders. However, the activities involved in the process, such as mining for codes, issuing a subrogation letter, can be automated. Insights obtained from the process can be used to train the data with a combination of features determining successful cases. The model is then applied to claims in the prepayment phase and subrogation propensity potential score is calculated.

In summary, we believe sophisticated analytics techniques applied in a customized solution to be the best approach to improve the payer’s outcomes. We are applying our expertise in machine learning and NLP techniques combined with process mining capabilities to tackle the payment integrity problem. In our experience with an insurance client, the combination of Automation and Intelligence in claims processing reduced the settlement time by 75% and saved the firm $18 Million through more accurate fraud detection. To know more about LatentView Analytics’ Intelligent Automation solutions, please write to consulting@latentview.com