In April 2020, after the COVID-19 pandemic caused lockdowns across the United States, over 80% of Auto Insurance companies announced that they will refund or credit drivers, the premium of more than $6.5 billion over the next two months, according to a report from Consumer Federation of America. The lesser congestion on roads and accidents, as a result — lesser claims filed, played a pivotal role in Auto Insurance firms making such key decisions.

This is one of the smaller examples of how the pandemic is reshaping the business landscape, societies, economies and consumer behaviour in an increasingly unexpected and uncertain way. Insurance Businesses aren’t different in that aspect. The Pandemic has forced insurance companies to reinvigorate themselves and have relook at their policy offerings and process optimization.

With the vaccine deployment about to begin in the next few months (subject to approval), Health Insurers are advised by the Centre for Disease Control (CDC) to cover the vaccination costs and also help in the outreach to high risk groups.

As businesses across several industries and the economy at large, is bouncing back to pre-covid levels, the Insurance Industry could see consumers adopting Usage Based Insurance (UBI), Telehealth Services and Businesses looking to mitigate risks through Cybersecurity and Business Interruption coverages.

Adoption of Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) offers vastly different benefits from traditional auto insurance plans where the premiums are thought of as fixed costs assessed quarterly / yearly, to variable costs based on miles driven and various driving behaviours.

With most states and Workplaces in the US under stay-at-home orders since the COVID-19 outbreak, data compiled by Google shows that Mobility trends for usually crowded places like Workplaces, Retail stores were down by at least 60% and 20% respectively, from the baseline traffic data. As people continue to work from home and make bulk purchases during grocery shopping, a greater number of individuals are driving fewer miles than they are used to.

Auto Insurers across the United States have refunded 15% to 40% of monthly premiums since April 2020 either as relief or as part of their Customer Giveback Program, due to reduction in the claims. Though these unprecedented events reduce the claims raised by the customers, it brings the traditional auto insurance pricing model into the spotlight, which relies heavily on the actuarial studies of historical data, profile drivers and provides discounts by means of bundling products/services as fixed price, to retain the customer base.

According to a study by Ernst & Young, 88% of all new cars in 2025 will have embedded telematics, which are pivotal in the data collection for UBI. The time is ripe for modelling the new age UBI products as consumer adoption looks to peak.

Benefits:

- For the Insurers, UBI has the potential to reduce the cost of claims and policy administration by 40% and 50% respectively. The telematics-based insurance and optimized claims management including First Notice of Loss (FNOL), can reduce the average total cost of a claim if reported within 30 minutes and will enable insurers to detect and prevent fraud

- Increases customer engagement through value-added services like contextual alerts and suggestions and thus adapting to their needs and lifestyle

In May 2020, J.D. Power studied the consumer sentiment on the impact of auto insurance premium refunds and the impact of telematics in the future. 59% of consumers believe their average miles driven will remain lower post-COVID and 40% of them were contemplating opting for Telematics programs because of the cost benefits.

Interests in Cybersecurity Insurance

Cybersecurity Insurance offers risk protection to individuals and businesses to protect them from the effects and consequences of problems related to information privacy that arise due to accessing information over the internet. It typically covers losses due to data theft, destruction, and benefits like Security audits and post-incident investigative expenses.

A recent study from the University of Chicago indicates that 37% of jobs in the US can be performed entirely at home. With companies increasingly shifting their strategies to make Work from Home a permanent policy, the second-order effects of this were felt in organizing face-to-face meetings with prospects and clients and in terms of collaboration among internal stakeholders. Office productivity apps and subscription services like G-Suite, Microsoft 365, Slack, Zoom, Notion saw spikes in their Daily Active Users (DAUs) after the COVID-19 outbreak.

These trends reinforce the need for having strong Cybersecurity practices implemented across organizations. According to a recent report from Kaspersky, the share of Cybersecurity in IT spending by SMBs has grown from 23% in 2019 to 26% in 2020, with 71% of the organizations that participated in the survey expecting the budget to increase in the next 3 years.

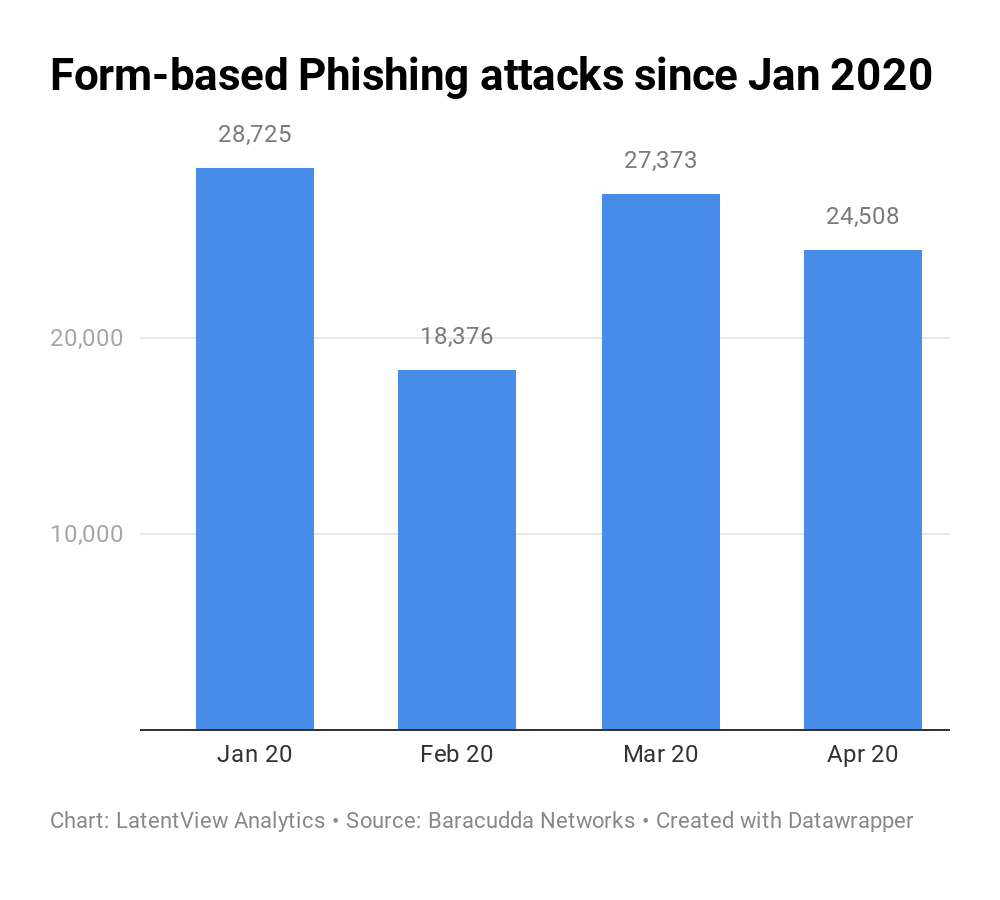

A study by Barracuda Networks from 100k form-based cyber attacks from Jan 2020 till Apr 2020 indicates, nearly 35% of the URLs were impersonation of content-sharing apps like Google Docs, Microsoft Office, Google Drive, and OneDrive, which forms part and parcel of every employee’s daily productivity stack.

As organizations continue to operate remotely in most parts of the world, the possibility of cyber attacks is more frequent now than ever and businesses are increasingly looking to mitigate the risk associated with it through Cybersecurity Insurance.

That said, the average cost of Cybersecurity insurance in the U.S. is about $1,501 per year. For the year 2018, direct earned premiums reported were $1.03B. The data from regulatory filings compiled by Rating Agency firm Fitch Ratings shows that the direct loss ratio for standalone cyber insurance rose from 34% in 2018 to 47% in 2019.

This brings the pricing decisions Insurers adopt while underwriting, into the spotlight, which currently is, more art than science while measuring risks with a subjective viewpoint. An important part of underwriting cybersecurity policies is, assessing the risk based on the organization’s practices and the protocols in place for IT Infrastructure Management.

With COVID-19 changing and reshaping the work environments, Insurers are increasingly working with third-party vendors to audit companies on cybersecurity practices and use the data to model the pricing and payout decisions.

Pandemic Coverage for Business Interruption

Pandemic coverage provides indemnity protection to the businesses in the event of losses due to business interruption.

In April 2020, it was reported that Wimbledon would receive a $141M payout as result of taking Pandemic Insurance, for the cancellation of 2020 Wimbledon at the The All England Lawn and Croquet Club. It had opted for pandemic coverage after the SARS outbreak in 2003. Wimbledon reportedly paid $2M a year for pandemic insurance for the last 17 years ($34M).

Over the last 50 years, 7 pandemic outbreaks had caused a total death toll of 40M. Diseases such as Zika, MERS, SARS, and now COVID-19 have had dramatic financial implications on myriad industries.

According to a study in the Bulletin of the World Health Organization, the worldwide spread of a serious infectious disease could result in pandemic-related deaths of 700,000 and annual economic losses of $500 billion. The expected annual loss in the US due to the pandemic is estimated at $79.65B.

While this looks like a worthy risk protection product for the businesses, business interruption coverage is provided as an optional coverage attached to commercial property insurance that is often (but not always) triggered only as a result of damage to physical property.

Insurers across the world have indicated that most policyholders have not acquired insurance coverage that will respond to the business interruption losses that result from COVID-19 business closures. In the US, for instance, exclusion was developed (more than 15 years ago) and has been applied with the aim of specifically excluding coverage for losses due to virus (or bacteria).

An essay from OECD (Organisation for Economic Co-operation and Development), an international economic policy think-tank, notes that, despite the exclusion in standard policies, an explicit coverage was developed for financial losses due to outbreaks, epidemics or pandemics and was made available. However, there has reportedly been almost no take-up.

With the disruption caused by pandemics across the value chains for several businesses, the demand for pandemic coverage is expected to increase. The Google Trends report for the “Pandemic Insurance” serves as a proxy for the pent-up interest.

The caveat with providing such plans from an actuaries perspective is, the substantial coverage cost and challenges it poses for ensuring broader coverage along with limited financial benefits in diversifying the exposure globally.

Expansion of Telehealth Coverage

Telehealth refers to usage of digital communication tools to distribute healthcare services and information between patients and healthcare providers.

The Outbreak of COVID-19 had a significant impact in the Outpatient care of Hospitals, as people are deferring their planned annual check-ups and other preventive visits to hospitals, to avoid the risk of being exposed to the virus.

Researchers at Harvard University and Phreesia, who analyzed the data from more than 50,000 providers, between Feb 2020 and May 2020, reported that as of May 2020, there was 38% decline in in-person visits, from the baseline numbers. The visit volume declined more significantly during March 2020 and April 2020, up to 59%. During the same period, the volume of telehealth visits increased rapidly, up to 14% during the month of April 2020.

Data from FAIR Health indicates that the telehealth claim volumes among the privately billed claims rose from 0.17% in March 2019 to 7.52% in March 2020. Besides the increase in consumer adoption and behavioral change, there are notable regulatory changes like broadening access to Medicare telehealth services, by the Centre for Medicare & Medicaid Services (CMS).

Benefits:

- Covering Telehealth services boosts relatively low levels of utilization

- Significant reduction in operating costs and payouts

- Insurers can enable accessibility to patients, by making them experience the healthcare system in an efficient and satisfactory fashion

Adapting to the new normal

Insurance Providers have placed operational enablement as the key area of focus in the pandemic affected world and will continue to be the area of focus for the post-pandemic world as well. This means, Insurers are accelerating the digitization of their business and closing the gaps on the Business Continuity front.

As consumer interests (like panic buying of Term Insurance policies) and customer behavior (like reduction in auto insurance claims reduced drastically due to lesser miles driven) are changing rapidly due to the COVID-19 pandemic, opportunities loom large and businesses are tapping into it by optimizing their process workflow using data-informed and data-driven decision making.

Insurance companies are looking to prioritize market segments based on customer propensity, Offer personalized product recommendations, build customized policies and see category creation as a growth strategy by launching on-demand, need-based & wellness products.

LatentView Analytics helps companies across a range of Financial Services and various other verticals, drive and accelerate their digital transformation journey, to gain competitive advantage. If you would like to know more about LatentView’s end-to-end custom analytics solutions, please write to marketing@latentview.com