Regardless of industry, business nature, or size, every sector is being crippled with risks and frauds globally. With the disruptions caused by the COVID-19 pandemic, more people are shifting to digital platforms. However, rapid digital adoption opens a myriad of doors for fraudsters who are looking for loopholes in the systems. Organizations across every sector share some common security risks and are constantly on the lookout for solutions to mitigate them.

Why should organizations focus on Risks & Frauds?

Fraudulent activities will not only affect the business financially but also pose a significant threat to the brand image and customer loyalty. 33% of customers say that they will not be returning to a platform after facing a fraud attempt.

It is difficult to state a conclusive figure for the losses through fraud as the majority is played under deception and some of those that are identified are not even reported, but, fraudulent activities are estimated to cause a loss of 7% of an organization’s annual revenue. The increasing digitization and online services provide an expanded scope and open up sophisticated tools to fraudsters. Globally, people are shifting to digital services and making their personal payments or business transactions online. Providing accessibility to users across different channels like mobile phones and websites is essential, but it is a source that fraudsters exploit through their vulnerabilities. So every transaction done on a customer’s end could open them up to a risk of attack.

Frauds are happening worldwide in every industry

A OneSpan blog post says over 15 billion stolen credentials are available on the dark web. Global payment frauds tripled from $9.84 billion in 2011 to $32.39 billion in 2020. It is further expected to cost $40.62 billion by 2027, 25% more than in 2020. The loss to occupational fraud worldwide is estimated to be $4.7 trillion as per the data by ACFE. These include corruption, non-cash misappropriation, financial statement fraud, and expense reimbursement.

With the meteoric rise of the digital ad industry, digital ad fraud has become a major concern. It is projected that fraudulent activities will cost around $44 billion to companies in 2022. Similarly, the e-commerce industry has grown phenomenally in recent times. Juniper Research had estimated that e-commerce would suffer a $20 billion loss in 2021, an increase of 18% compared to the previous year.

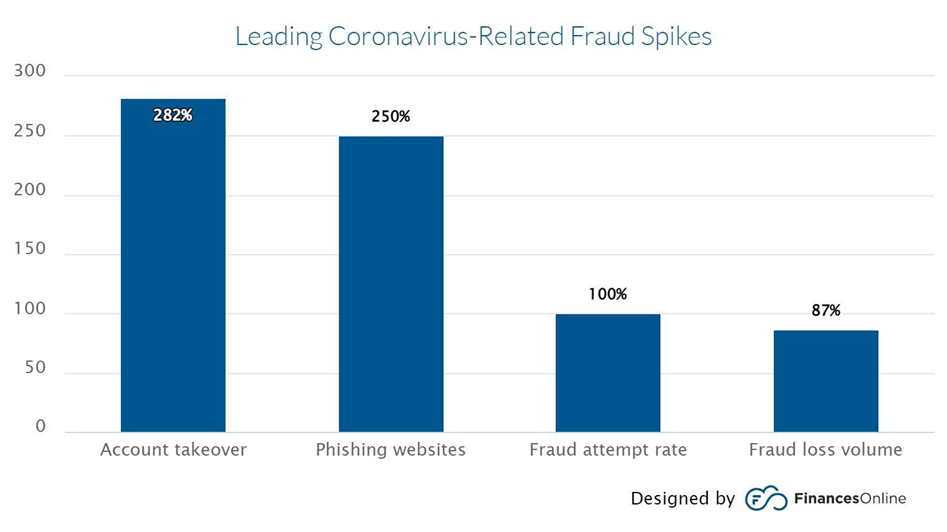

During COVID-19 outbreak, there is a significant shift observed in customers’ purchasing behavior. Due to digitalization, many firms invested heavily in digital commerce apps and platforms. According to the European Payments Council, account takeover (ATO) attacks showed the biggest increase (282%), followed by phishing websites (250%), fraud attempt rate (100%), and fraud loss volume (87%) in a tally of COVID-related fraud increases.

The general use-cases of frauds prevalent in the digital industry

Frauds may vary from industry to industry, but some general use-cases are compiled below from various studies.

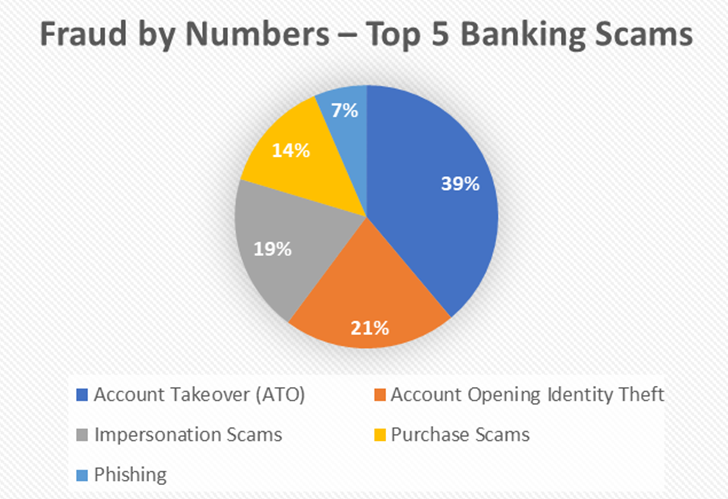

- Account Takeover (ATO) Frauds: ATO is a type of identity fraud where the fraudsters gain access to existing accounts by using the stolen credentials or identifiable data of an individual and then implement their fraudulent schemes. Bot attacks are also some of the prevalent ways through which the attacks are attempted. According to Imperva Research Labs’ 12-month review of cybersecurity risks affecting e-commerce, bots were responsible for 57% of all assaults on e-commerce websites in 2021, compared to 33% for all other businesses.

- Stolen Financials: This case is rapidly increasing compared to other frauds. The fraudster in this instance utilises stolen card credentials to make a purchase on a platform that does not require a physical card. By 2023, this fraud is expected to rise by 14%, costing retailers $130 billion.

- Friendly frauds: When a buyer keeps the things purchased online but wants a refund stating reasons like non-delivery, payment is already made, or the purchase was never completed, this is known as friendly fraud. This is a kind of loss where merchants lose money and goods. Statistics say that the global average cost of chargebacks is around 0.47% of total merchant revenue each year. In 2016, the e-commerce business lost an estimated $6.7 billion in sales owing to chargebacks, with friendly fraud accounting for 71% ($4.8 billion). Chargebacks on credit cards are increasing at a rate of 20% each year.

Conclusion

With many more types of fraudulent activities crippling the industries, companies are now using data and analytics to monitor and prevent fraud. Data analytics can help you identify the fraud patterns and develop a model to prevent them from happening. It also enables you to dive deep into the anomalies, monitor the defined metrics, and help curb fraud-related losses. It is important to determine the risks at every stage of fraud and deep dive into the process flow to root them out.