The multi-billion dollar services industry in the United States is undergoing a massive shift in how business is performed. A primary instrument of change in the industry are service marketplaces. Service marketplace platforms connect individuals who can provide a service with individuals who need that particular service. Many of these businesses have become household names – think Uber, Airbnb etc. However, when it comes to these marketplaces, one imposing threat/challenge to their success is Platform Leakage.

Here’s a common scenario when it comes to online marketplaces – a traveler planning a vacation checks out places on Airbnb and instead of booking their stay through the platform, they reach out to the host directly to book the accommodation. The reverse happens, too. Hosts may offer a cheaper rate if guests booked directly to avoid paying commission to the marketplace. In industry parlance, this leakage is commonly called ‘disintermediation.’ Disintermediation is a backdooring process where the buyer and seller complete the transaction outside the platform to avoid paying any transaction/service fee.

Nearly every online marketplace encounters the problem of disintermediation resulting in revenue loss for the marketplace. Largely, the approach to address this problem can be grouped into two categories – proactive and reactive. In this blog, we will look at how both of these approaches work and understand their strengths and limitations. We will also look at the case of a leading global ecommerce marketplace, which was plagued by disintermediation to the extent of five percent of its revenues and how LatentView Analytics’ solution was able to plug this leak.

Proactive Approach

In the proactive approach, the marketplace actively works to add a greater value proposition so that both the buyer and the seller feel compelled to complete the transaction using the marketplace. By doing this, the marketplace can ensure that the benefit of completing the transaction on the platform exceeds the monetary benefit gained by circumventing it.

There are several ways marketplaces can increase the value proposition.

Building Trust: Marketplaces can foster greater trust and credibility between the seller and the buyer. This can be done through rating systems, user reviews, and testimonials to build a community around the experience. They should also consider providing some level of guarantee for service quality, delivery time, or payment. For example, on eBay, a buyer and seller may review each other after a transaction. Each user’s profile displays a ‘reputation score’ that buyers and sellers may use to evaluate each other.

Security: To instill the sense of security into the minds of customers, brands come with ‘Guarantee’ claims. Tell your customers that you offer ‘One Hundred Percent Guarantee’ on each item. Should any item underperform or fail to meet the customers’ expectations, replace it with a new one or offer cash-back schemes. If you implement this in both policy and execution, letter and spirit, it results in repeat purchases.

Insurance: By offering insurance to the buyer and the seller, in case they encounter losses or damages during the course of the transaction, the seller and the buyer can offset the risk they would have otherwise borne. For example, Airbnb provides insurance to hosts’ properties in the event that they are damaged by the guests. If the host had bypassed the marketplace, they would have otherwise had to bear the cost of repairing any damages.

Savings on volumes: A buyer and a seller may save some money on a single transaction. But, what if they could achieve greater savings as the volume of transactions increase? For example, marketplaces can lower fees if sellers achieve a certain volume of sales. Likewise, for every transaction that a buyer completes on the marketplace, they can be given points that can be redeemed at a future date. Such schemes are also known as loyalty programs.

Reactive Approach

Despite the best efforts of the marketplace, some buyers and sellers may still choose to circumvent the platform. The marketplace may have to put in place terms and conditions to deter buyers and sellers from transacting outside the platform. This essentially forms the reactive approach.

The first thing marketplaces can do is to establish a set of rules on how transactions will be conducted over the platform. Sellers must sign a formal agreement accepting that they will not transact outside the marketplace. Buyers must be made aware, at regular intervals, of the risks of transacting outside of the platform.

A major point of disintermediation occurs during the course of initial communication between the seller and the buyer. Marketplaces facilitate this communication in order to help sellers gain more clarity regarding product customization, shipping, returns, refund policy, and any other questions that buyers may have. Buyers and sellers may use this opportunity to exchange contact information with the intention of taking the transaction outside the platform.

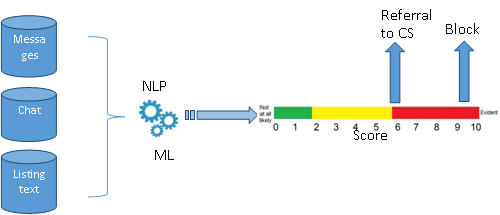

Marketplaces must identify the different checkpoints of a transaction and take measures to prevent any circumvention. Marketplaces must monitor communications on the platform with the help of leading-edge technologies such as Natural Language Processing (NLP) and machine learning algorithms to identify any potential disintermediation. Both buyers and sellers must be aware that their interactions over the platform may be monitored so that there is transparency.

Figure 1: Use of NLP and ML can help identify potential disintermediation

When a leading ecommerce company faced a five percent leakage in revenue (inspite of them taking proactive approaches such as insurance, guarantees, and refunds), they wanted to leverage the power of technology and advanced web analytics and customer analytics to plug the leak.

LatentView Analytics built a machine learning model to address this challenge and monitor such member to member communication (messages indicating intent to take the transactions off the marketplace or exchanging contact information). This would be raised as a ticket and would subsequently be flagged off to the customer support team to look into the history of the buyer’s and seller’s transactions for a complete evaluation. If there was substantial evidence of disintermediation, the customer support team would issue warnings up to three times. The seller is charged five percent of the transaction fee after the fourth instance. This is now included as part on the standard terms and conditions in the policy. Each flagged message is assigned a score between zero and one. A score greater than 0.8 would lead to a fine without notice or warning. This process occurs in near real-time. Within 60 seconds, the score would be calculated, the seller intimated, and necessary action taken. It was also used to obfuscate any contact information that is shared by the buyer and the seller. While this model resulted in reducing disintermediation on the platform, it is important to remember that ML models may not always be accurate. Therefore, human intervention by the customer support team analyzes the case before any punitive measures are taken.

Conclusion

Both proactive and reactive approaches have strengths and weaknesses. A single approach may not be effective in preventing disintermediation. Therefore, marketplaces must implement a combination of the two approaches to leverage the strengths of both. If you want to own the purchase process, you need to provide enough value in the transaction—both for the customer and the provider. If your providers are individuals renting or selling products, you should focus on trust and security. If your providers are professionals, consider building tools that help them run their business. Make it as effortless as possible for your customers to make the purchase.

Leveraging a 360-degree view of the marketplace

Marketplaces are shrinking the world and changing the way we shop and work. As they fight to remain at the crossroads of suppliers and buyers, leveraging payments can be the difference maker for keeping users on platforms and engaged. The only way to stave off the disintermediators is to provide such a compelling and relevant customer relationship, that your customers will not allow someone coming between them and their favorite retailers, restaurants and service providers. To understand how LatentView can help drive customer analytics in your organization, write into: marketing@latentview.com