In 2022, online CPG sales are projected to account for 10% of the total US CPG market, up from approximately 4-5% in 2019 [1]. Millions of consumers bought CPG products online for the first time in 2020 [2], and this shows that the eCommerce trend is here to stay. Over the past few years, CPG Brands have realigned their strategy towards increasing digital channels. The three major routes CPG Brands can take in selling their products online are – Acquiring a Direct-To-Consumer (DTC) Brand, launching a DTC Brand, and Selling products through E-retailers.

- Acquiring a DTC Brand: CPG brands acquiring independent digitally native brands and using their established supply chain to sell their products online.

- Launching a DTC Brand: CPG brands investing in DTC models to build direct relationships with customers, collect first-party data, and personalize the customer experience across different brand channels.

- Selling Products through E-retailers: CPG brands dependent on E-retailers such as Amazon, Walmart Online to sell their products online.

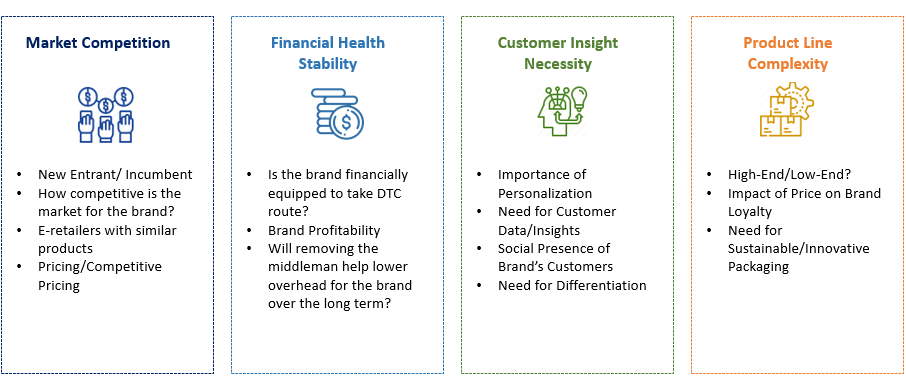

However, there are certain criteria that a CPG brand must meet to choose an eCommerce Route, which include:

Market Competition: A measure of how competitive the market is for the products that the brand is selling. Higher the market competition lower the opportunity space for the brand to grow. Market competition is evaluated based on the following factors:

- Is the CPG brand a new entrant to the market or an incumbent in the highly crowded market?

- How many E-retailers have private-label products similar to those the brand sells? (Ex: Amazon and Kroger have private label brands Solimo and Simple Truth selling Oral care products)

- How important is competitive pricing for the products the brand is selling? (More and more customers are comparing prices online before purchasing a product online to ensure they get the best price on the market).

Financial Health Stability: This refers to measuring the brand’s monetary affairs, including liquidity, solvency, profitability, and operational efficiency. The factors under which Financial health stability is evaluated are as follows:

- Is the brand financially equipped to take the DTC route?

- How has the brand fared financially for the past few years?

- Will removing the middleman help lower overhead for the brand over the long term?

Customer Insight Necessity: This is a measure of the importance of Customer Insights for the brand’s future growth. Customer Insight Necessity is evaluated based on the following factors:

- How important is personalization for the products the brand is selling?

- Does the brand have any control over its reputation and how people perceive it?

- Is it necessary for the brand to differentiate its products from those of its competitors?

Product Line Complexity: The factors based on which Product Line Complexity is evaluated are given below:

- Is the brand catering product to either the high-end market segment or low-end market segment?

- How loyal are the brand’s customers, and do they switch between brands if offered a low price?

- How much innovative/sustainable packaging does the customer expect from your brand?

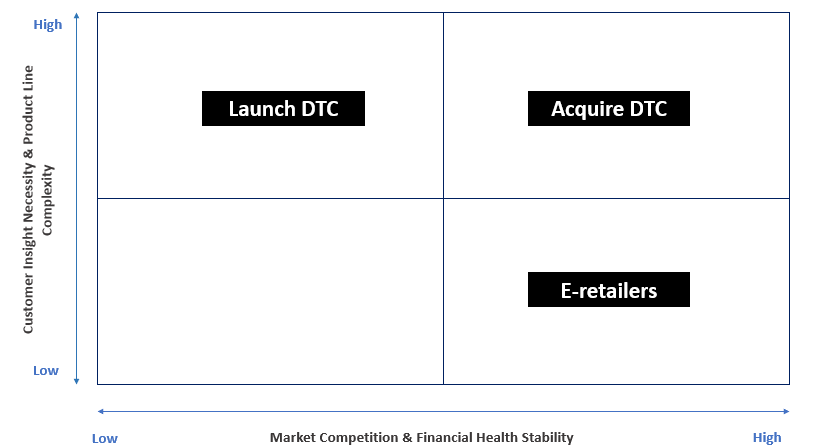

Based on the criteria mentioned above, the framework for choosing the CPG eCommerce route is as follows:

Under what circumstances should a CPG brand launch a DTC Channel?

- Market Competition – low

- Financial Health Stability – moderate

- Need for customer insights – high

- Brand catering to high-end market/product segment

By adopting a DTC channel, the brand will have access to firsthand consumer insights and use them to personalize and customize the products for the customer. The best way to test DTC grounds is by selling the premium products first and then add low-end products if proven successful.

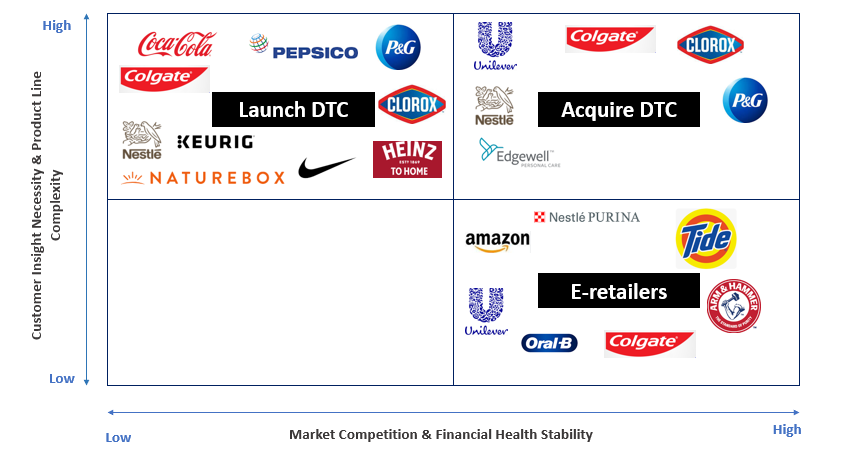

Over the past few years, several CPG incumbents have launched a DTC channel. For example, Coca-Cola has launched Cokestore.com (Personalizing products for customers), PepsiCo has launched Pantryshop.com and Snacks.com, Colgate sells high-end personalized products such as Electric toothbrushes, Teeth Whitening kits under Shop.Colgate.com. In addition, since 2019, Nike had pulled its products from e-retailers and decided to sell its products under its own DTC channel. On the other hand, new entrants like Nature Box are launching their own DTC (selling snacks on subscription) platforms.

Under what circumstances should a CPG brand acquire another DTC brand?

- Market Competition – high

- Financial Health Stability – high

- Need for customer insights – high

- Brand catering to high-end market/product segment

By acquiring an independent, digitally native DTC brand, incumbents can establish a strong foothold in that market. Financial health stability needs to be high to acquire a DTC brand because incumbents end up paying more than 3x the revenue of the independent brand to acquire it.

Over the past few years, several CPG incumbents have acquired DTC brands. Unilever acquired Dollar Shave Club (Paying approximately 5x the yearly revenue), Graze (Snacking brand), and Schmidt’s Naturals (Beauty & Personal care brand). Colgate had acquired Personal care brands such as Elta MD and PCA Skin, while P&G acquired Personal care brands such as Walker & Company, This is L, and First Aid Beauty.

Under what circumstances is a CPG Brand better off with E-retailers?

A CPG brand is better off selling its products through E-retailers if

- Need for customer insights – low

- Market competition – high

- Brand catering to low-end market/product segment

Price greatly influences the consumers’ purchasing decisions in this space. Low-end products from Arm & Hammer, Oral-B, Tide, Colgate, Unilever, and Nestle are still sold on Amazon and Walmart Online. Brands need to optimize their product listing in E-retailers such as Amazon to compete in this space effectively. A previous blog on the LatentView Analytics website titled How can CPG Brands win the Amazon Battle discusses this. But in the longer run, for these brands to sustain, they need to build differentiated products that utilize customer insights and tend to the high-end market.

In summary, the four criteria – Market Competition, Financial Health Stability, Product Line Complexity, and Customer Insight Necessity decides which route a CPG brand must take to excel in eCommerce. In this three-part blog series, the following two blogs will discuss the success stories and challenges of taking each route for CPG eCommerce. In addition, we will also be exploring the upcoming channels for CPG eCommerce, such as Voice Commerce, Social Commerce, and Quick Commerce.

At LatentView Analytics, our data science experts seize the opportunity to make sense of big data and turn them into insights for our clients to make data-driven business decisions. Get in touch with us at marketing@latentview.com to know more.

Partner with Us

References

- https://www.statista.com/statistics/813367/online-cpg-sales-share-united-states/

- https://nielseniq.com/global/en/insights/analysis/2021/online-cpg-sales-in-the-u-s-are-booming-but-theres-still-room-for-growth/

- https://www.forbes.com/sites/forbescommunicationscouncil/2020/07/20/why-dtc-is-the-next-step-for-cpg-brands/?sh=53a1e9a2e5bb

- https://www.forbes.com/sites/forbescommunicationscouncil/2020/10/08/how-cpg-brands-are-using-dtc-to-stay-competitive/?sh=cedc1d04fca8

- https://www.gep.com/blog/mind/cpg-companies-should-not-procrastinate-on-direct-to-consumer-initiatives

- https://feedvisor.com/resources/amazon-shipping-fba/how-cpg-brands-can-optimize-for-long-term-profitability-on-amazon/